Benchmarking Group Image study 2013 – Brand funnel

In September 2013, a group of cities known as the Benchmarking Group carried out a survey among a representative sample of their citizens on the image they have of the other cities.

In September 2013, a group of cities known as the Benchmarking Group carried out a survey among a representative sample of their citizens on the image they have of the other cities.

The Benchmarking Group is composed of Amsterdam, Barcelona, Berlin, Copenhagen, Gothenburg, Lisbon, Munich, Paris, Vienna and Zurich, and, for the purpose of this study, Saint Petersburg.

More than 4,000 people were interviewed, mostly via an online questionnaire applied to existing consumer panels from those cities. In this article we provide only aggregate results, our aim being to present the concept underpinning the results.

One of the study’s objectives was to build ‘brand funnels’ for the participant cities on the several source markets available in the sample. Through a set of questions, we wanted to determine the extent to which cities were present in consumers’ minds. In a naturally descendent path, a city, as leisure tourism destination, can go from being simply a place the consumer has heard of, to a destination that they have already visited and are willing to visit again.

Our questions about the participating cities were the following:

- Which of the following cities have you heard of?

- Which of the following cities are you familiar with? Please select those cities you have a concrete idea of e.g. sights, atmosphere, economy, history, culture, entertainment, gastronomy

- Please think about city trips within Europe. Which of the following cities do you find attractive for a leisure city trip?

- Which of the following cities are you planning to visit within the next 2-3 years for a leisure city trip?

- Have you ever visited any of the following cities for a leisure city trip?

- Which of the following city would you like to visit again for a leisure city trip?

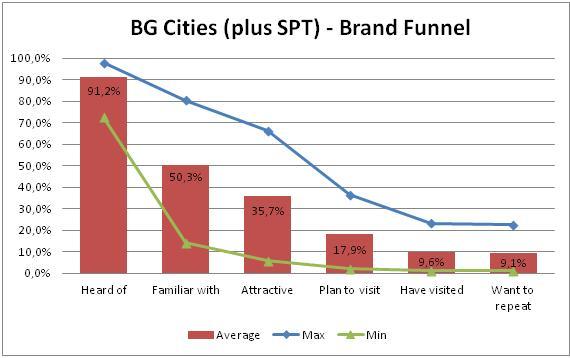

The aggregate results we obtained are expressed in the following chart:

On average, 91% of those interviewed had heard of the study cities, which meant that the existence of those cities was almost totally identified. The city with the highest percentage got 97%, and the one with the lowest got 72%.

However, on average, only half of the sample was capable of establishing a concrete idea about the city as a tourism destination. Yet the results varied according to city. The highest rate was 80%, while the lowest was only 14%. On average, we can say that, when moving from being known to being a place the consumers could picture, the positive results were halved.

Almost the same happened when going further, we tried to find out whether a consumer’s concrete idea was in the sense of considering the “average city” attractive to visit: only 35% said yes. Again, the results were a bit different from city to city.

Becoming more concrete again, we established that only less than 20% of those interviewed were planning to visit this “average city”, and that less than 10% had already visited it.

But one very interesting result is that this average city, despite not being as attractive as one might have expected, once visited leaves an impression to the point that the person wants to repeat the experience. The percentage of people having visited the city, and the percentage of people wanting to repeat it was pretty much the same. This was true for every city individually.

As stated above, we chose to present only aggregate results to show how this concept works, but, of course, the most value can be gained from seeing how each city performs individually against the others on the different source markets.

This analysis provides important information on how your destination is placed in the mind of potential consumers from each source market, in comparison with other cities. Am I more attractive than my competitor? Am I capitalising on that attractiveness better than others, by “persuading” more people to visit my city? Or do I have to become more known (familiar) – again, relative to other cities – , so I can better show my attractiveness, and convert it into more visits?

These are all questions which studies like this can answer, by analysing how your destination is placed against competitors, how many potential visitors you may be “losing” along the set of six questions, and comparing it with the results of your competitors.

Contact:

André Moura

Turismo de Lisboa

amoura(at)visitlisboa.com