European City Tourism Monitor XXII – summary

Optimism has increased – more than three out of four of our expert respondents are confident of a positive 3rd quarter in 2014

Optimism has increased – more than three out of four of our expert respondents are confident of a positive 3rd quarter in 2014

According to the results of the 22nd European City Tourism Monitor, a total of 79% of city tourism professionals participating in the survey expect bednights in the 3rd quarter of 2014 to increase, compared with the same period in 2013. Expectations for the whole of 2014 compared with 2013 are roughly the same as the 2nd quarter (94%). As many as 93% of respondents are expecting growth in total bednights for the whole of 2014.

3rd quarter

79% of those interviewed expect bednights in their city destinations to grow in the 3rd quarter of 2014. This is an increase compared to both 1st and 2nd quarter of 2014 expectations, where 64% and 73% expected a growth in total bednights. The majority of experts (57%), expect growth to be of between 1 and 5%, whilst 22% believe that bednight volumes will grow by more than 5%. 17% of respondents believe the number of bednights will be similar to last year, and 3% are expecting a decrease in total bednights in the 3rd quarter of 2014.

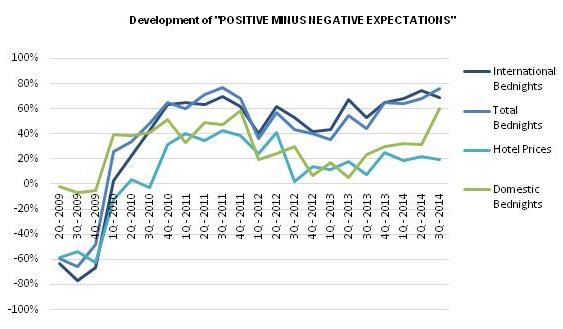

Compared to the previous survey, the difference between positive and negative expectations has slightly increased within the figures for total bednights and markedly so for domestic bednights. The gap between positive and negative expectations regarding international bednights and hotel prices has slightly decreased.

Growth in the 3rd quarter is expected to come predominantly from the leisure segment and from both domestic and international markets, though subject to regional differences. On average 66% of all respondents are expecting domestic growth and 69% international growth. In the last report, these figures were in comparison 32% for the domestic markets and as much as 80% for the international bednights.

Looking at the six markets included in this report, growth is expected to come mainly from the German and the British markets. The American and Italian markets are likewise expected to increase, whilst bednights from the French and Spanish markets in particular are expected to remain approximately the same.

Overall, expectations for hotel prices are not as positive as expectations for bednight volumes. For most regions, experts expect hotel prices to stay the same, though there are regional differences, notably the Southeastern and Southern/Southwestern regions where a large majority of respondents believes prices will remain the same.

Year 2014 Expectations for the whole of 2014 in terms of total bednights are considerably more positive than expectations for the 3rd quarter of 2014.

Expectations for the whole of 2014 in terms of total bednights are considerably more positive than expectations for the 3rd quarter of 2014.

As many as 93% expect a growth in total bednights in 2014, with the majority (73%) expecting a growth of plus 1% to plus 5%. Just 2% expect the total number of bednights to stay the same, whilst 6% expect a decrease in the number of bednights in 2014.

The results are largely the same as the findings of the previous report. In the last quarter 94% of respondents expected growth for 2014; the figure this quarter is 93%.

Key factors affecting tourism in the 3rd quarter 2014

18% of our experts mention that future planned events will have a highly positive impact on growth in the next three months of 2014. Furthermore, 16% mention increasing accessibility, in terms of new air routes etc., as a factor that likewise will influence future development. The category ‘meetings and congresses’ is also a component that is expected to have a positive influence on tourism; 13% of the experts’ suggest that these will have a positive effect in their respective cities.

The economic situation has in previously reports highly impacted tourism and this report is not an exception. 9% of our expert respondents are still concerned with the economic situation, while only 9% are optimistic about the economic outlook. To compare these figures, in the previous report 9% were concerned about the economic situation and 12% were optimistic about the economic outlook.

‘Increasing demand’ and ‘marketing and communication campaigns’ were given as additional key factors expected to influence tourism in the 3rd quarter of 2014.

For further details on this report, or the project, please contact:

Lone Alletorp Callard (Author of this report)

Wonderful Copenhagen

lac(at)woco.dk