Q3 2018: Long-haul arrivals in Europe did not balance intra-European arrivals despite growing intra-regional air capacity

The latest results from the Air Travellers’ Traffic Barometer*, produced by European Cities Marketing and ForwardKeys, highlighted that arrivals from all long-haul travellers enjoyed single-digit growth and went up by an overall 5.6%, not balancing enough the decrease of the intra-European arrivals (-7.8%) which represented half of International arrivals during Q3 2018.

European intra-regional air capacity is healthily growing

European intra-regional air capacity is healthily growing

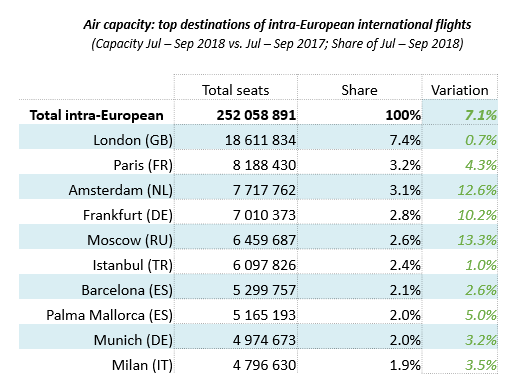

New element of the report, intra-regional air capacity, grew by 7.1% in Q3 and will sustain solid growth in Q4, +9.7%, as per scheduled international flights within Europe. Among best connected destinations, Moscow and Amsterdam will enjoy solid increases of regional air capacity.

Long-haul arrivals increased by 5.6% in Q3 2018 compared to Q3 2017

Long-haul arrivals experienced an increase of 5.6%, with all long-haul sub-continents getting single-digit growth. However, intra-European travel showed a very poor performance with a decrease of 7.8%. This resulted in a small decrease (-1.6%) in total international arrivals in Europe during Q3.

London and Paris are still dominating the top 2 destinations for long haul travellers and Istanbul (3rd) is growing fast

London (18% share) and Paris (14% share) maintained their predominance as the top two destinations for long-haul travellers. Istanbul was the top growing destination in terms of share (8% share), increasing by 2 percentage points from last quarter.

Forward bookings for the fourth quarter are more optimistic than Q3 2018

Forward bookings for long haul arrivals in Q4 are ahead by 8.5%, fuelled by the optimistic bookings’ situation for North America (13.6% ahead) and Middle East (13.2% ahead), while smaller origin regions Africa (-0.9%) and Central & South America) have a flat-negative outlook.

London (17% share) and Paris (14% share) are still the preferred destinations for the last quarter of the year, followed by Rome (9% share), representing together more than a third of arrivals in Europe. Istanbul (+51.5%) gains back its predominantly position in terms of growth, followed by Munich (19.8%) and Dubrovnik (+18.6%).

Stronger growth in the leisure travellers’ segment than in the business travellers’ segment

The traveller profile for long-haul arrivals maintained a growing leisure-related behaviour. This was indicated as segments typically associated with leisure travel grew the most: 3 to 5 pax, couples and groups of 6 or more, with medium lengths of stays (4 to 13 nights), and longer lead times of 90 to more than 120 days.

All ECM members have exclusive access to the complete European Cities Marketing-ForwardKeys Air Travellers’ Traffic Barometer with all the graphs and analysis.

*This analyse is based on Air Reservation Data propriety of ForwardKeys® as of 30th September 2018. Perimeter: Includes air reservations made by passengers arriving in Europe and staying at least one night in destination, therefore excluding: “Transits”, “Day trips”, “One-way trips” and “Returns”.

Arrival period: 1 July – 30 September 2018 vs. 1 July – 30 September 2017.

Booking situation for next quarter: 1 October – 31 December 2018 vs. 1 October – 31 December 2017 according to bookings issued as of 30 September 2018 and as of 30 September 2017.

**ENDS**

*European Cities Marketing is a non-profit organisation improving the competitiveness and performance of leading cities of Europe by providing a platform for convention, leisure and city marketing professionals to exchange knowledge, best practice and widen their network to build new business. European Cities Marketing is promoting and linking the interests of members from more than 110 major cities in 38 countries.

For more information and pictures, please contact:

Flavie Baudot, press@europeancitiesmarketing.com, +33 380 56 02 00

** ForwardKeys.com is a service of Forward Data S.L, a Market Research and Consulting Company registered in Spain. ForwardKeys is a Business Intelligence service bringing a new approach to operational traveller data intelligence for Hotels Chains, Tourism boards and Destination Management Organizations (DMOs) leveraging non-confidential Air reservation information. ForwardKeys provides to:

‐ DMOs and Tourism Boards with travellers’ trends information and means to monitor and measure the impact of their marketing efforts to drive more business to their destination.

‐ Hotel chains with ways to quantify future demand and anticipate market trends to optimize sales, marketing and revenue management efforts, using traveller’s reservation, source market, arrival, return date and future travel information.

Contact information

Laurens van den Oever, press@forwardkeys.com